By Brian Nejmeh & Jon Sappey

As the final blog in our series on strategy debt, we decided to touch on the role of the private equity investor on strategy debt. The connection may seem odd at first, but our experience in doing strategic narrative work with clients is that not understanding investor sentiment and expectations can create strategy debt.

Recall from our previous posts (Part 1, Part 2, Part 3), we indicated that companies incur strategy debt when they fail to clarify their intent with stakeholders, especially their own employees who are left to act in self-interested and/or expedient ways – creating unnecessary cost and strategic inefficiencies for the organization over time. In our early strategy work, we did not automatically include discovery on investor sentiment and most critically investor exit time horizon, expectation for return, willingness to provide additional working capital and desired product positioning (and in turn expected exit valuation range) for the company upon exit. Any strategic narrative devoid of these investor considerations inherently accrues strategy debt. Why, you ask? Simply this: that exit time horizon and availability of capital dramatically impacts strategic options. Therefore, any strategic narrative created absent those considerations accrues strategy debt.

The Investor’s time horizon time-boxes the scope of the strategic narrative. An investor exit time horizon of 12 months vs 3 years has consequential impact on the ability to execute on the strategic narrative. As a strategic narrative is aspirational in nature, it is clear that it describes a future state of the company and its product(s). Thus, it is important to distinguish the overall future state strategic narrative and the progress that will be made executing on the strategic narrative at the time of exit. A strategic narrative that is too futuristic is likely to not be very appealing or valuable at the time of exit, as the company has not demonstrated its ability to execute on it.

Similarly, the investor’s willingness to provide additional capital may constrain the ability for a company to execute on strategic options, when timelines elongate and assumptions evolve. Care must be taken to create a strategic narrative in line with capital available prior to a desired exit. Again, a strategic narrative that is too future-state oriented and lacks any proof points of execution will not likely be very appealing or valuable at the time of exit.

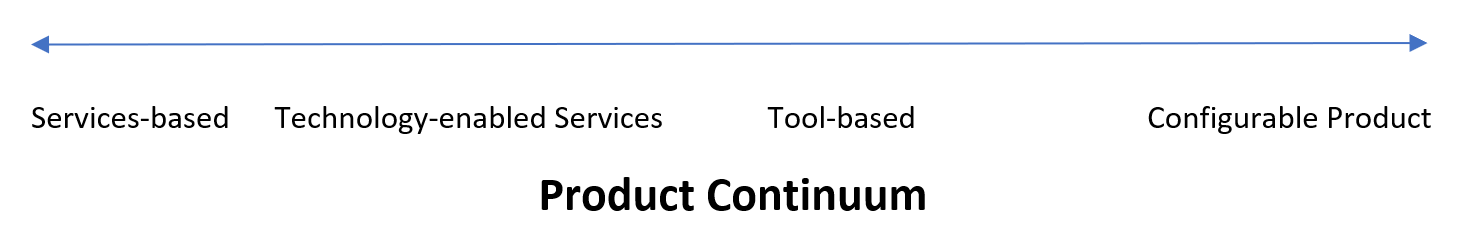

The investor’s desired product positioning, and the associated expected exit valuation range, is another area for misalignment. Software companies can be positioned at any place on the product continuum shown below.

The valuation multiple differences for companies positioned and executed on the right end of this continuum versus those at the left end of this continuum are dramatic. For example, it is not uncommon for services-based companies to be valued at less than one-time annual revenue. For pure-play SaaS companies with strong ARR, momentum (CAGR > 30%) and high retention (> 90%), multiples can be 8-15x future ARR.

Obviously, PE investors desire for their companies to be positioned and executing as configurable products. The problem is, many companies position that way, but far fewer are executing as pure-play configurable SaaS products. Furthermore, the investment in time, capital, talent and technology required to re-orient the product, company and business models from the current model (i.e., services-based, technology-enabled services, etc.) to configurable product model is massive. Care must be taken to not assume all companies are capable of becoming configurable product companies in the timeframe and capital available for exit.

Strategy debt related to investors can begin as early as the closing of a capital raise or M&A transaction, or at any point thereafter. Regardless of when or how it was created, retiring investor-related strategy debt can be a complicated and unpleasant experience. Like all debt, strategy debt related to investors can either be dealt with or lived with. Strategy debt related to investor expectations will inevitably create board tension and questioning of the executive team. This could lead to (a) investors changing their expectations and behavior, (b) a change in the company strategic narrative consistent with investor expectations, (c) a change of company leadership to new leadership aligned with the investor expectation. More often than not, we have seen a combination of all three scenarios play out. Orchestrating these discussions with investors sometimes brings about ethical challenges, as we have seen very publicly with the Theranos case and others.

In summary, the strategic narrative process must begin with a clear understanding of investor exit time horizon, willing to provide capital and exit valuation/company positioning expectations. Here are questions we now ask as part of our client onboarding process:

- How long has the current investor group been invested in the company and at what valuation?

- What is the investor group exit time horizon?

- What is the investor group willingness to continue to fund the company (assuming free cash flows do not provide sufficient future working capital)?

- What is the investor exit valuation expectation viz-a-vis the product positioning and execution model?

- How far is the company from that reality and does the investor group understand that gap?

In summary, if not well understood, agreed upon, accounted for and aligned with, investor expectations can create strategy debt.