You cannot have sustainable long-term product success with just customer success. Sustainable long-term product success also requires shareholder success (akin to shareholder value). As detailed in a related blog, my thesis is that achieving the proper balance of customer success and shareholder success over time is an important balancing act as customer success and shareholder success evolve dynamically through the stages of the technology adoption life cycle (TALC). Thus, I have developed an MVE (minimal viable equation 😊) for a formulaic expression of Product Success.

Defining Customer Success

Customer success is some function of customer experience (CX) and customer value realization (CVR). CX is the series of on-going interactions along the buyer journey between the customer and the provider. These experiences include buyer discovery, trial use, subscription and renewal management. Initially, CX consists of the experience of configuring and provisioning the customer solution, as well as onboarding and training the customer to rapidly achieve time to first value. Over time, CX includes proactive customer success engagement, as well as customer support to ensure timely resolution of customer issues. Finally, effective CX includes ongoing touchpoints with the customer to ensure pro-active voice of customer discovery and action.

CVR is a critical success factor for all SaaS companies, but it can be elusive to measure and track if not explicitly part of your whole product per my recent blog. CVR begins with the adoption and utilization of SaaS whole product capabilities in support of users completing their jobs to be done. In turn, the utilization of capabilities must lead to the customer achieving their desired business value realization outcomes in value units defined by the customer. Equally important, the capabilities of the whole product must make it abundantly clear to the customer the value they realize in the terms of the customer.

What About Shareholder Success?

Shareholder value is some function of the annual recurring revenue (ARR), the growth rate of ARR, the lifetime profitability of the product and the overall attractiveness of the product position in the market. ARR is an important consideration in its size as it indicates a level of market and product maturity and scale. In both cases (ARR and ARR growth), these numbers, relative to your category at large and those of your competitors are important shareholder value indicators. Annual growth rate is critical as it is an obvious demonstration of something shareholders value – momentum!

The lifetime profitability of a customer over time is also a key shareholder success consideration. Obviously, the stage of your category and the maturity of your product influence profitability. Companies in pre-Chasm categories or with immature products will likely not be profitable compared to companies with mature products in Tornado and Main Street stages of category adoption which should be significantly profitable and growing their profit margins. Much of the ARR and profitability factors of shareholder success derive from the widely held Rule of 40.

One final intangible factor in my shareholder success expression is position attractiveness. This factor accounts for a number of intangibles that have a material impact on shareholder value. Position attractiveness includes the attractiveness of your category, your source of sustainable competitive advantage and risk of commoditization (asset and capability IP, unique technology, data analytics, brand power, privileged partner relationships, etc.) and other attractive “intangibles”.

The Product Success Equation

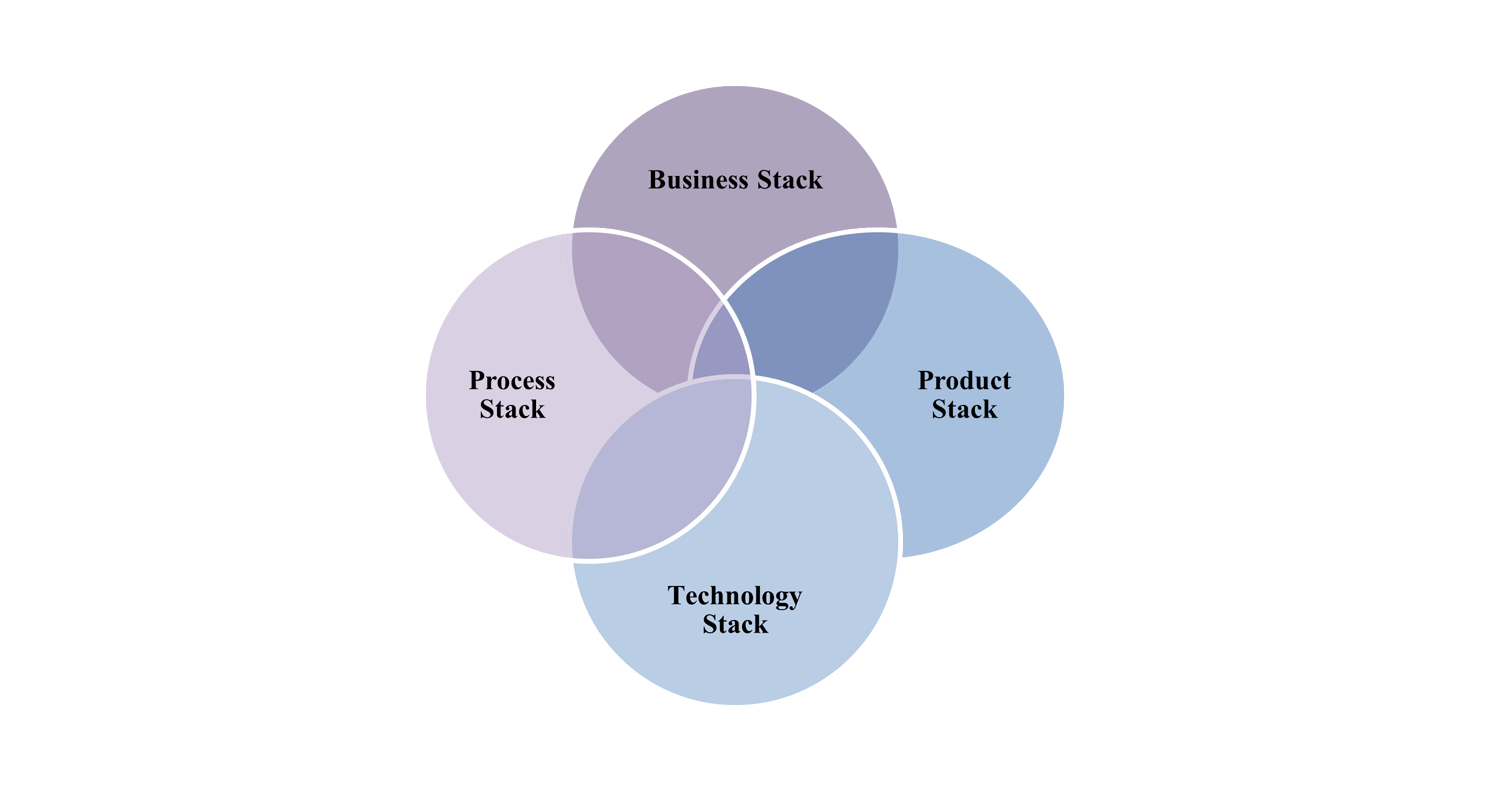

The previous narrative serves as background context for my proposed MVE for product success.

Product Success = function (Customer Success, Shareholder Success), where

- Customer Success = function (Customer Experience (CX), Customer Value Realization (CVR))

- Shareholder Success = function (ARR, ARR Growth Rate, Lifetime Profitability, Position Attractiveness)

Finally, it is critically important to consider the ratio of:

The degree of focus on customer success among SaaS companies is well-founded given that a strong CSM function is highly correlated to net dollar retention (> 110%) and logo retention rates (close to 100%). In turn, strong net dollar and logo retention rates are strong predictors of a SaaS company’s growth rate (recent OpenView study). Nonetheless, there needs to be an equally important emphasis on shareholder success and managing the inherent tension between the two. Early in the TALC, Customer Success will likely exceed Shareholder Success. However, as a product matures across the TALC, Shareholder Success will likely exceed Customer Success. Said another way, there are times early in the life of a product where customer success is more readily apparent and shareholder success is not measurable in financial terms, but more in terms of market acceptance, competitive wins and target segment growth. As the product matures, shareholder success becomes more readily apparent in terms of ARR growth and profitability at scale. Suffice is to say, there are also times when a pre- or low- revenue stage company is acquired at a premium due to its projected future financial performance, thus nullifying the notion that customer success exceeds shareholder success in the early TALC stages.

Another factor in both the customer and shareholder success formulas is employee and team performance, satisfaction, and incentives. For those employees with customer success and/or shareholder success objectives, their individual and team performance and satisfaction also influence customer and shareholder outcomes (HBR article). Management must attend to potential distortions based on incentives driven disproportionately by one or the other.

Do you agree with the product success equation? Is this something you would use when looking at your own company? If so or if not, I’d love to get your thoughts on these equations via our post on LinkedIn.