Introduction

A major milestone for SaaS companies is achieving a premium exit. The term “premium” indicates that a buyer willingly paid a premium price for the SaaS company. “Exit” indicates that the company was sufficiently mature or technically advanced in an important emerging category at the time of the transaction – that another company desired to purchase it. This premium exit for SaaS companies can occur in several ways, including (1) a recapitalization in which the majority of the company is purchased by a private equity firm, (2) a merger with or acquisition of the company by another company or (3) an initial public offering.

There are many important factors that influence the value of a SaaS company upon exit, including: historic and projected financial performance, product portfolio, market size, market traction, category performance and life cycle, competitive landscape, and an experienced SaaS management team. Collectively, these factors determine whether a company is sold, and, if so, whether a premium multiple is paid for the company at exit. The difference is certainly non-trivial. Take a look at the BVP Cloud Index and you will see the huge premium that well-run SaaS companies command over traditional companies. Lists of top-tier SaaS companies abound; a well-regarded list is the Forbes Cloud 100. The SaaStr community and the BVP Cloud100 are excellent sources of insight about “best in class” SaaS companies and practices.

My focus the past decade has been on both the buy and sell side of B2B SaaS companies. In particular, my product and technology background has focused my attention on the product-related factors (i.e., product strategy, product management, product development, technical debt, product architecture, etc.) that influence a premium SaaS exit. I am often asked, “What are the key product considerations that influence the premium exit value of a SaaS company?” Based on my experiences, there are ten clear product imperatives that a company must focus on to achieve a premium exit.

The Ten SaaS Product Imperatives

Let’s briefly examine each of the ten product imperatives I consider to be critical for a premium SaaS exit.

1. Market-validated Strategic Narrative

A company should show clear evidence that they are driven by an underlying strategy that is grounded in the realities of their category and market. The company should have a regularly refreshed strategic narrative, created through a robust market-sensing strategic planning process. The executive team should be using the narrative to drive both market-facing activities and internal resource allocation and portfolio management. The narrative should be updated at least annually and offer a compelling case for the company category, target markets, value proposition, product-market fit, positioning and competitive differentiation. For a reasonable illustration of a strategic narrative and external positioning, see the article about Uberflip.

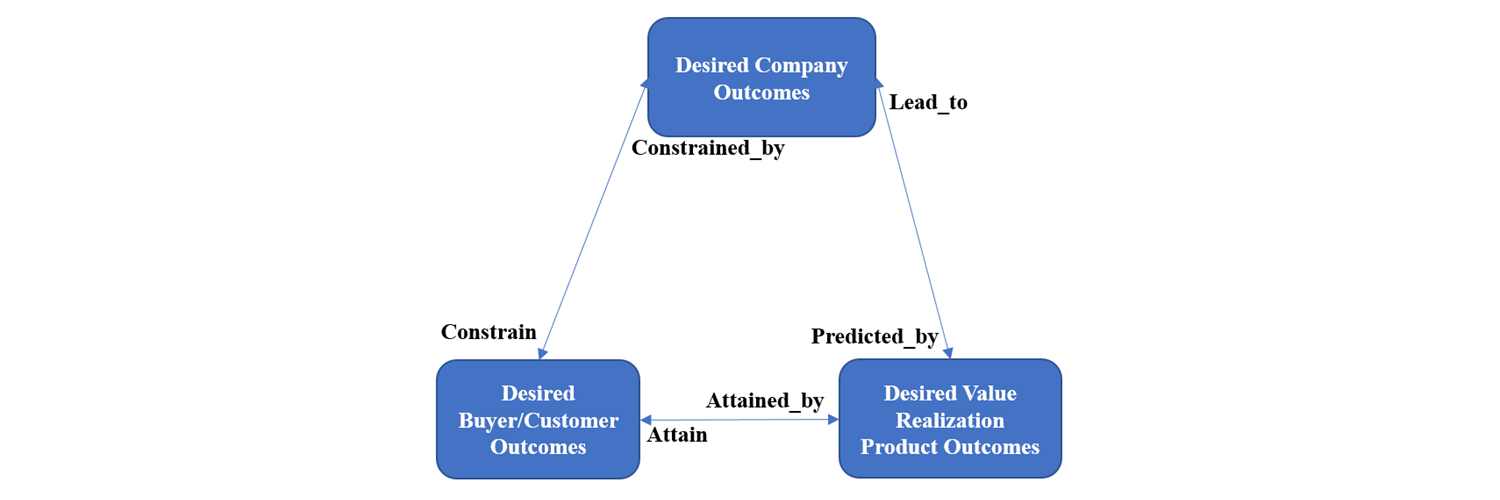

2. Sustainable Competitive Advantage

It is important for a company to clearly understand, articulate and validate their overall approach to value creation and source of sustainable competitive advantage. There are many possible sources of such advantage including (a) proprietary and patented algorithms, (b) subject matter expertise (SME), (c) extensive historical (transactional and/or workflow) data and trend analysis and (d) brand. For premium-valued SaaS companies, these sources of differentiation manifest themselves in unique product capabilities and in the business value realization outcomes of customers. A great example of competitive advantage comes from Tesla, my example of a SaaS-on-wheels company with millions of lines-of-code powering the car and recently reporting $1.5B in software revenues. This article does a nice job of highlighting the five major sources of competitive advantage enjoyed by Tesla: software, Tesla AI, battery supply chain, supercharger network and branding. My recent analysis indicates that Tesla’s valuation is roughly 3.6 times that of the combined Big Three automakers (GM, Ford, Fiat Chrysler) despite Tesla only having 6% of the revenues of the combined Big Three. Now that’s a valuation premium!

Note that combinations of factors can be particularly powerful in long-term differentiation, as so many differentiating capabilities can be readily reproduced by competitors in today’s disruptive tech world. Executives have to be honest with themselves about differentiating capabilities.

3. Product Acquisition Acuity

Many successful privately and publicly held SaaS companies are highly acquisitive as they look to sustain aggressive growth rates, fuel innovation and expand their market share and categories over time. Thus, product acquisitions that demonstrate successful integration of the people, processes, technologies and products of an acquired entity into a company’s product portfolio reflect the ability to execute on synergistic and accretive M&A transactions. This bodes well for premium value. Acquisitive behavior in and of itself is not an imperative; however, evidence of failure to integrate acquired assets can substantially depress the valuation of a company. SaaS pioneer Salesforce.com, the fasting growing SaaS company ever, exemplifies a well-run acquisition model as a core tenet of its growth story. To date, Salesforce.com has acquired 60+ companies, allowing it to reach a $20B revenue run rate ahead of plan. Their strategy has included notable acquisitions of Tableau, MuleSoft and ClickSoftware Technologies. To appreciate the premium value Salesforce enjoys over their biggest competitors SAP and Oracle, Salesforces’ trailing 12-month revenues ($19.4B) are 70% those of SAP ($27.8B) and 50% those of Oracle ($39.2B), yet Salesforce has a market cap ($214B) 67% greater than SAP ($128B) and 24% greater than Oracle ($172B).

4. Disciplined Product Organization

A sound product management organization – with a disciplined, mature and well-automated product management life cycle (PMLC), organizational structure and management team – are critical markers looked for at exit. This includes a well-defined and repeatable PMLC such as the 5PMM Model and an appropriate complement of tools such as those covered in the 5PMM Tools Taxonomy.

An observation I would offer here is that while company founders drive the original product vision, care must be taken to ensure that the product management process matures over time, driven by market strategy and whole product vision. In contrast, a completely sales-driven product culture tends to be short-sighted and may de-value a company. This is because a sales-driven product culture can rapidly accumulate technical debt due to development expediency. In turn, such technical debt often manifests itself as a hindrance to future growth.

In terms of product discipline, it is expected that a SaaS company has mastered some form of Lean or Agile (Scrum, SAFe, Kanban) data-driven approach to product development and delivery and customer success. Companies that have a regular pattern, rhythm and cadence for steady and consistent releases to production are viewed favorably at exit. Such production releases occur with various periodicity ranging from daily/weekly (mobile apps) to every 2-12 weeks (larger enterprise software). In short, a disciplined product organization drives innovative company growth by focusing on important categories, attractive markets and great whole product-market fit. Such discipline increases the likelihood of future innovative growth for future investors and owners.

5. Whole Product Roadmaps

The “whole product” is everything the customer needs to be successful to realize the business value goals they have when adopting your product. This includes not only your software capabilities, but also robust integration to adjacent applications in your ecosystem, customer community portals, certified 3rd party service providers, multi-touch customer success processes and tools, etc. This imperative focuses on the company’s history of successfully mapping and executing on strategic whole product roadmaps informed by the strategic narrative and the many feedback channels in today’s market (i.e., user-data-driven insights from tools like Gainsight and Pendo, industry analyst feedback, prospect feedback, win/loss analysis, competitive analysis, etc.). Roadmaps that demonstrate the ability of the company to successfully execute on ecosystem whole product and channel partnerships also contribute to premium valuation.

6. Highly Configurable and Self-service Whole Products

The consumerization of enterprise software means that the software must be self-describing and self-service oriented, affording the user ease of enrollment, personalization and use. Self-service is simply the idea that it is easier for a user to accomplish something than it is for them to engage with the company to accomplish it. A second critical consideration is configurability — a software product adaptability strategy to enable non-development personnel, such as professional services organizations and VARs, to efficiently and effectively provision, configure, deploy and “get to live” a new customer. Software configurability is about making anticipated product changes easy to make for affected parties. Configurability stands in stark contrast to customizations, which are unanticipated product changes that require access to application source code and (possibly) product development staff. Gross margin and time to production and value are all indicators of sound product configurability and self-service. Google apps offers an excellent example of both a highly-configurable product set for IT administrators, as well as being very self-service friendly for end-users. An ecosystem of satisfied and reference-generating partners is often the clearest indicator of success in this imperative.

7. Cloud Architecture

A multi-tenant, containerized hyper-scalable cloud architecture that leverages serverless computing can create significant development efficiencies and cost saving competitive advantages if done well. Such an architecture – deploying a single production version of highly configurable and self-service oriented software for all customers – enables the company to maximize the business value of SaaS and is a core premise of a premium-valued SaaS company. A critical indicator of cloud maturity in a SaaS company is gross margin of at least 80%, suggestive of a high degree of customer cloud tenancy and efficient use of cloud services. REST API-based microservices, auto-scaling cloud infrastructure, ease of API and data in/out integration and full participation in API ecosystems are all critical components of a mature SaaS architecture. Critical architectural “ilities” that impact valuation include scalability, reliability, availability, secureability, compliance, recoverability and performance. In terms of security, there is an increasing need to certify the security of application delivery and governance processes. It is critical to obtain certifications of the company’s application and IT security governance model, such as those offered by ISO 27001 (information security management) and SOC 1/2/3® (Systems and Organizational Controls). A company must have well-defined and practiced processes, tools, governance, metrics and actions in place to ensure that the various “ilities” service level agreements are defined, delivered upon and test assured in the whole product. Technical debt in such an environment requires minimal development capacity.

Many companies started before 2010 often come from an on-premise heritage and are in some stage of their journey to cloud (ref), dragging technical debt along with them. These companies often fall well short of the mark regarding the cloud imperative, leading to a devalued exit or significantly delayed exit, or both. Clearly, pure-play SaaS companies born in the cloud have an inherent advantage over such heritage companies when it comes to cloud, making it all the more important to clarify and execute on cloud strategy.

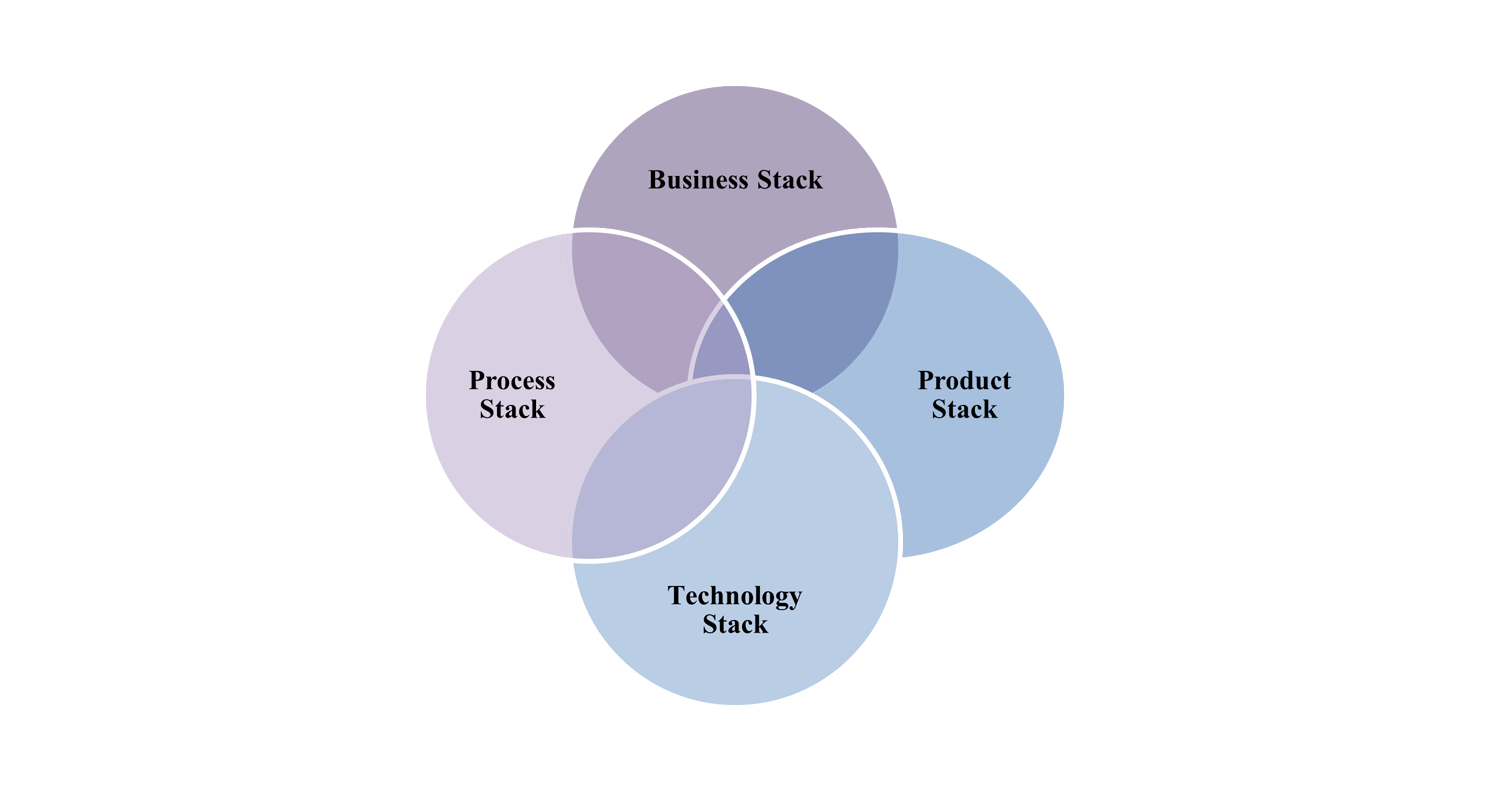

8. Platform-enabled Product Portfolio

SaaS companies that leverage some form of platform, or factored out set of common services used across the product portfolio, are viewed favorably at exit. Such platforms contribute to development and time to market efficiency and overall product quality. Platform common services include cloud and infrastructure services (computing, storage and bandwidth) as well as application services such as data persistence, UI/UX components, workflow, reporting/BI, API and data integration services, single-sign-on, etc. Such platforms typically leverage commercially available IaaS and PaaS offerings from leading cloud platforms (AWS, Azure, GCP) and other COTS and open source technologies. Such platforms, if effectively sourced and utilized, can free up scarce development resources to create sustainable competitive advantage and reduce technical debt. In contrast, a development organization with a “not invented here” mentality that has evidence of re-inventing the wheel instead of exploiting proven available technologies is a surefire way to devalue a company. The Salesforce Platform offers a solid PaaS platform used by both Saleforce.com and a large and growing third party ecosystem of SaaS vendors. For example, NCIno, a recent fintech IPO with a $6B market cap on trailing 12-month revenues of $170M, is a SaaS pure-play company built on the Salesforce Platform.

9. Customer Success Management (CSM)

In SaaS, everybody in the company is selling and selling never stops. Companies must create user experiences and outcomes that customers cannot live without and drive increased usage. Remember, subscribers can unsubscribe from your service with relative ease. CSM is the discipline, processes and tools used to ensure that customers efficiently and effectively onboard and achieve their business value goals, thereby allowing a company to increase customer retention, reduce churn, increase customer use of software and optimize customer recurring revenue. CSM is also critical to achieving broad customer referencability, another factor in a premium SaaS exit.

CSM is not simply a new label slapped on a legacy Customer Support function. Companies must ensure that customers are able to efficiently and effectively derive the value they expect from their products. The CSM function must relentlessly remain on a mission to do everything it can to maximum customer value. CSM leverages cloud intimacy to understand customer adoption and behavior in truly different ways. Leading CSM platforms such as Gainsight and Pendo are critical tools used to define, mature and manage CSM.

The clear presence of a mature, results-oriented CSM organization, processes and tools are critical to achieving a premium-valued SaaS exit.

10. Product Line Financial Performance

The most mature SaaS organizations are those whose product managers are the CEOs of the product line, inclusive of product-level P&L.

Well-known cloud-based investment firm Bessemer Venture Partners (BVP) has done a great job evangelizing the key product-related financial metrics for SaaS companies, known as the Five Cs. In some sense, the Five Cs define the scorecard for the aforementioned product imperatives as they encompass product, as well as sales, marketing, CSM, etc.

- Committed monthly recurring revenue (CMRR): this is the amount of recurring subscription revenue your customers are generating in a single month per product.

- Cash flow: total cash received during the month minus total expenses paid during the month (inclusive of debt and finance charges) per product. Cash flow is typically reported in the form of a “rolling three-month average” to account for short-term variances in collections and payables.

- Customer acquisition cost payback period (CAC): the time period, stating in months, that it takes a company to fully recover its sales and marketing investment to close a customer per product. In general, CAC of less than 18 months is a good target.

- Customer lifetime value (CLTV): the average amount of money that your customers pay over their lifetime as a customer per product. The CLTV:CAC (cost to acquire a customer) ratio is an extremely important metric in valuing a SaaS company. A CTLV:CAC ratio of 4 is considered good. A ratio of less than 3 implies an inefficient sales and marketing function. A ratio greater than 5 may suggest the company is underinvesting in sales and marketing and can increase investment in those areas to the benefit of the company. Many would argue that CLTV should be calculated on a true variable cost basis, or at least take gross margin into account. The point here is that what customers pay a company is less relevant than the cashflow a company derives over the lifetime of a customer taking into account the costs to deliver the customer revenue.

- Churn (customer, revenue): Customer churn is the % of total customers abandoning your service each month per product, with 0% customer churn being ideal. Revenue churn is the amount of revenue paid by customers abandoning your service each month per product as a % of your total revenue. A metric related to revenue churn is net retention rate (NRR) stated as a % of total value of renewed contract (including up-sell and cross-sell) per customer per year per product. NRR greater than 110% is considered good.

In addition, the rule of 40, the principle that a SaaS company’s revenue growth rate and profit margin should combine to exceed 40% per annum plays a role in determining the premium value of a SaaS company. The rule of 40 explains why a SaaS company with revenue growth of 80%, but losing 35% (for a +45) may be valued at a premium compared to a company growing at 12% and generating an 8% profit margin (for a +20). Take for example the publicly held company DocuSign (NASDAQ: DOCU). A recent Q4, 2019 Rule of 40 analysis done by Scale Venture Partners puts DocuSign at 43.4% (YoY 39.9% GAAP revenue growth + 3.5% EBITDA excluding stock-based compensation). Recurring revenue growth and profitability momentum are among the most critical determinants of a premium-valued SaaS exit.

Summary

I was once an executive in a software company funded by legendary Silicon Valley venture firm Kleiner Perkins (KP). These many years later, I can still hear the sage advice from a KP partner telling me at a board meeting,

“Do not worry about who your acquirer will be. Focus on a sound market-driven strategy and stellar execution and the rest will take care of itself!” This is still sound advice and is the surest way to a premium exit.

The ten product imperatives outlined above are a solid product foundation to consider as you grow your SaaS company. Clearly, it is difficult to fully achieve success in each of the imperatives.

My experience suggests that the single greatest way to accelerate SaaS maturity in a given area (i.e., product management, CSM, etc.) is to hire proven SaaS executive talent who bring a wealth of proven experience, processes, tools and personnel with them – and can multiply their expertise through mentorship and team building. I see companies moving unproven SaaS executives into leadership positions. There is no excuse today for “on the job” executive SaaS training with the wealth of proven SaaS executive talent available.

The executive team must address the timing and focus on these imperatives based on the maturity of the company in each of these areas and the shareholder timeline for exit and willingness to invest in SaaS maturity. Consideration must be given to the imperatives that offer the highest ROI for SaaS company valuation improvement consistent with your exit horizon timeline.

The best practice in this area is to develop an explicit roadmap for achieving SaaS maturity with QSRs (Quarterly SaaS Reviews) to assess progress and revamp the roadmap.

SaaS maturity requires significant leadership commitment of time, attention and benchmarking against “what good SaaS looks like.” In this regard, periodic SaaS product benchmarking reports and metrics, including those from KeyBanc , SaaS Capital™, OpenView, Insight Partners, Shea & Company, Pendo and Gainsight can inform your SaaS roadmap. Indeed, a best practice is to explicitly define SaaS maturity metric targets for various imperatives and to have some portion of variable compensation aligned with achieving SaaS maturity milestones.

In short, a SaaS company should be intentional about the ten product imperatives as they mature their products and company over time. Doing so can have a profound impact at the time of exit.

Do you have thoughts or opinions on what you just read? Let us know what you think by leaving a comment on LinkedIn