As those who follow me on LinkedIn know, I’ve been spending a lot of time lately with B2B SaaS companies focused on value. Outcome-driven product management focuses on the key jobs to be done and their associated pain points and desired outcomes. Desired outcomes are buyer-defined job completion success metrics associated with a specific buyer job to be done. For some aspects of B2B value, such as solving concrete business problems (i.e., increasing revenue, reducing cost, etc.), desired outcomes are easy to define. The problem is there are many intangible aspects of value in B2B SaaS.

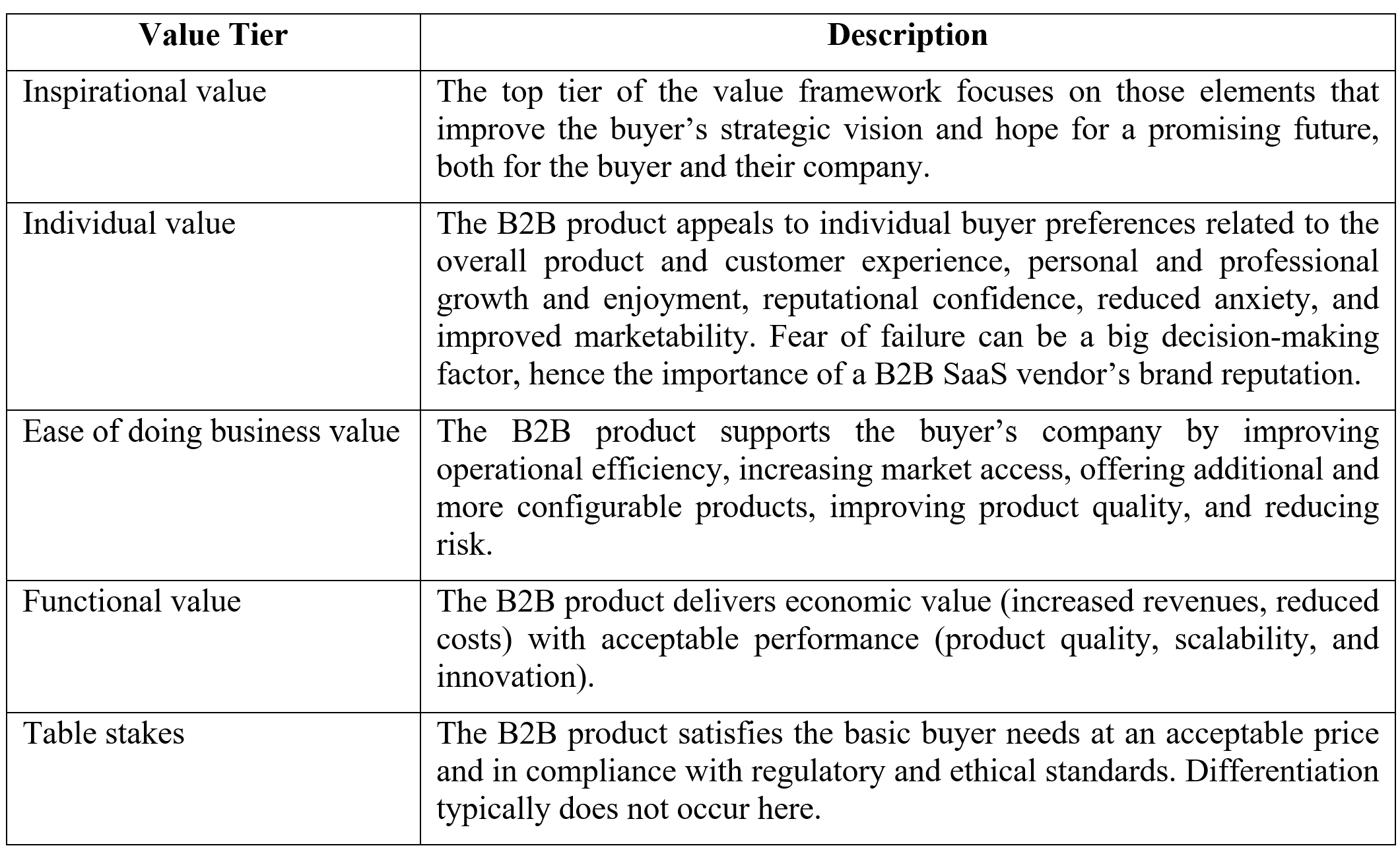

I have found the Bain work on B2B value to be insightful for B2B SaaS companies. The model defines a five-tiered hierarchical value model. The five value tiers are briefly described below.

Most B2B buyers and SaaS companies focus on the table stakes and functional value elements. The Bain work indicates that the B2B battleground for competitive differentiation will be in the non-transactional and difficult-to-measure areas at the middle and top elements of the value hierarchy (inspirational, individual, ease of doing business). For example, the Bain research showed that in some cases B2B buying decisions are influenced by “considerations such as whether a product can enhance the buyer’s reputation or reduce their anxiety play a large role”. Bain went on to say that for a “… product manager, mastering the intangibles of the customer’s total experience — all the service, support, interactions, and communications [of the whole product] — is much harder than making an offering faster cheaper or more durable.” The Bain work also indicates that the highest predictor of loyalty (to SaaS companies that means retention, expansion, and advocacy!) are: product quality, vendor expertise, and responsiveness. This certainly argues for a proper focus on these product and customer experience attributes for a product manager.

How might this Bain study inform B2B SaaS company product strategies? Here are a few thoughts.

- Differentiation: B2B SaaS companies must look beyond table stakes for sources of sustainable competitive advantage. Is your product’s source of competitive advantage focused on one or more of the higher value tiers in the hierarchy (inspirational, individual, ease of doing business)?

- CSM: How well does your product and the CSM function of your company support the success of the customer through in-app product capabilities, pro-active outreach, deep SME, and overall responsiveness?

- Product quality: Are product quality and continuous qualitative and quantitative product-market-fit (PMF) an ongoing high priority?

- The Intangibles: Does your company shy away from pursuing high-value elements that may be difficult to quantify but are important to a buyer? What is the reputation of your company’s brand in the market and how is it impacting the buyer decision-making process?

- CVR: Does your company have a systematic and customer-centric approach and automation to demonstrate customer value realization against desired outcomes (where possible)?

The Bain work offers a fresh and challenging perspective on value in the context of the B2B buyer. It may be time for B2B SaaS companies to reflect on their view of value through the Bain buyer lens.