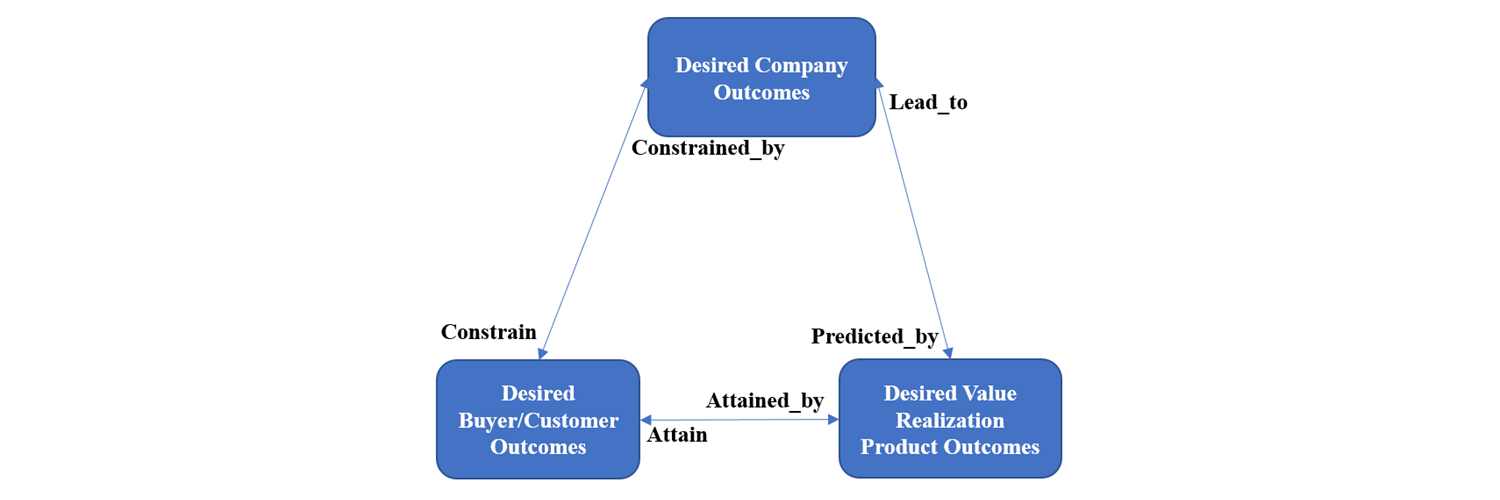

B2B SaaS Chief Product Officers (CPO) have embraced the “outcome over output” mantra. That is, outcomes are desired results the buyer or company wants to attain. Outputs are actions taken or items delivered that contribute to attaining outcomes. For example, fixing a bug is an output that contributes to the outcome of attaining a higher company CSAT score. Similarly, a group scheduling feature is an output that contributes to the outcome of reducing the time it takes to schedule group travel. The next question is then, whose outcomes? In my work with B2B SaaS companies, I observe three sets of inter-related outcomes the CPO must maintain in balance: desired company outcomes, desired buyer/customer outcomes, and desired value realization product outcomes. Let’s take a closer look at all three types of outcomes and some of their inter-relationships.

Desired Company Outcomes

Desired company outcomes for a B2B SaaS company are financial performance and power metrics related to the performance, and in turn, valuation of the company. Leading SaaS financial performance metrics include Annual Recurring Revenue (ARR), Bookings, Cumulative Annual Growth Rate (CAGR) of ARR, Profitability, Lifetime Account Value (LTV), Gross Revenue Retention (GRR), and Net Revenue Retention (NRR). However, financial performance metrics alone do not tell the full story. The strength of your company and products in attractive categories and markets also factors into your valuation. Geoffrey Moore’s Hierarchy of Powers model outlines power metrics related to company growth and value that come from the positional strength of your product in its category, target markets, product offerings, and your company’s ability to execute. Moore’s power metrics include:

- category power (total available market size of the category)

- company power (category market share and your growth rate relative to the growth rate of the category)

- market power (target market share and your target market growth rate relative to the growth rate of the category)

- offer power (leadership position with industry analyst firms (e.g., Gartner Magic Quadrant) and B2B SaaS review sites (e.g., TrustRadius)) or percentage of competitive deals won by your product)

- execution power (ability to execute against financial and power metrics and deliver on desired buyer outcomes)

Company outcomes are financial performance and power metric targets of the form:

- Name of financial or power metric

- Target value

- Timeframe for achievement

Company outcomes should be prioritized by the company in terms of importance. I prefer to see no more than three company outcomes being pursued at any one time. I also prefer outcomes that have different timeframes for achievement (i.e., by next quarter, by end of H1, by end of year). Company outcomes must also be negotiated between all key internal stakeholders to ensure internal alignment.

Consider Tripit.com, the travel planning app. Imagine that the Tripit.com executives decided to pursue the team travel planning market. Let’s call this product Tripit Teams. Let’s suppose the executives set a revenue target of $1M ARR within one year of launch. In this case, a company outcome metric would be the financial performance metric of $1M ARR target within one year of product launch. There would also be other company outcome metrics related to product-market-fit, target market share, etc.

In the case of venture capital or private equity-backed B2B SaaS companies, the investors expected exit time horizon and exit valuation range, expected rates of cash burn, growth and profitability, and positioning of the company at the time of exit all influence company desired outcomes. In B2B SaaS companies a CPO must have a clear understanding of desired company outcomes or strategy debt will not be far behind.

As an aside, I also work with companies that build SaaS apps for internal users and select external partners. In such cases, the financial performance and power metrics may make sense (Bookings, CAGR, target market share, etc.). In addition, internal company metrics related to cost reduction, productivity gains, new products, operational efficiency and effectiveness, workforce development, etc. may also make sense.

Desired Buyer/Customer Outcomes

A second type of outcome that a CPO must manage are desired buyer (customer) outcomes. A core premise of outcome-based product management is that buyers hire products to get jobs done and deliver on desired buyer outcomes. Company outcomes constrain buyer outcomes. For example, consider a B2B SaaS start-up whose product category is in the bowling alley adoption stage with company desired outcomes related to product-market fit and target market share for “pragmatists in pain” (i.e., early adopting) buyers in select target markets. Such a company should not focus on buyer outcomes for conservative buyers or those outside its target markets.

There are a number of different “outcomes to be delivered” frameworks available. Any of them can be used to define desired buyer outcomes. A leading buyer outcome framework is Jobs to Be Done (JTBD) made popular by Ulwick and Christensen. A desired buyer outcome is defined in terms of:

- desired performance regarding the completion of a buyer job

- a direction for improvement

- a performance metric

- an object of control (the outcome) and an optional contextual qualifier on the circumstances of the job being performed.

Regarding direction for improvement, JTBD recommends the use of words such as minimize, maximize, reduce, or increase to indicate the desired direction for improvement of a performance metric. Regarding key metrics, JTBD recommends the use of select key metrics such as time, likelihood, frequency, amount, risk, or numerical value. The object of control is the focus of the desired outcome (i.e., what is the buyer trying to get done?). The JTBD buyer outcome statement takes the form of:

- Direction of Improvement

- Key metric

- Object of control

- Optional contextual qualifier

Buyer/customers outcomes should be prioritized by the company in terms of importance. The importance of buyer outcomes is influenced by factors such as: extent to which the customer outcome contributes to a company outcome, relative importance of the customer outcome as ranked by customers and prospective buyers, and a general sense of the feasibility of achieving the desired customer outcome. I prefer to see no more than six customer outcomes being pursued at any one time. Customer outcomes should also have different timeframes for achievement.

As an avid Tripit.com customer, if I were to focus on jobs to be done and desired outcomes for team travel, the top two desired outcomes I would prioritize are:

- Increase (direction of improvement) the frequency with which I successfully collaborate with teams (key metric) to plan a group trip with my teammates using Teams (object of control)

- Reduce (direction of improvement) the calendar time it takes the team (key metric) to successfully plan a group trip using Teams (object of control)

Desired Value Realization Product Outcomes

SaaS is about buyers (now customers) realizing their desired job-related outcomes through the use of the product and making such outcomes readily apparent to customers. Buyer/Customer value realization (VR) is the process through which a customer, by adopting and using a product, is able to attain their job-related desired outcomes. Customer VR begins with the adoption and utilization of SaaS products in support of users completing their jobs to be done. In turn, product utilization leads to the customer attaining their job-related desired business outcomes. A Customer VR product outcome is a product-generated self-service measure, attained by the use of the product and expressed in customer-recognized value units, that indicates that the customer attained a desired outcome with the product.

SaaS is also about realizing desired company outcomes. Company Value Realization (VR) is the process through which a company, as a result of customer adoption and usage of the product, is able to attain their desired company outcomes. A Company VR product outcome is a product-generated self-service measure, achieved as a result of customers using the product and expressed in value units defined by the company, that correlates and leads to the attainment of a company outcome. Ideally, a product outcome leads to desired company outcomes (e.g., higher retention, increasing NRR) AND aligns with desired buyer outcomes.

A real-world example from Nick Mehta at Gainsight is illustrative here. One of Gainsight’s top features is Data Designer and it has two interesting correlations:

- Customers that use Data Designer have dramatically higher NPS scores AND

- Customers that use Data Designer tend to retain at higher levels.

The Gainsight example demonstrates how a product outcome (e.g., product adoption and usage) leads to a desired company outcome (e.g., higher customer retention levels).

I refer to both Customer VR and Company VR product outcomes collectively as product outcomes. Product outcomes are commonly expressed in terms of OKRs of the form:

I will [Objective] as measured by [Key Results]

The Objective is the overall goal you want the customer or company, through the use of the product, to achieve. In the case of Tripit Teams, the customer objectives might include:

- increasing the frequency of successful team collaboration to plan a group trip and

- reducing the calendar time it takes teams to successfully plan a group trip.

The Key Results are metrics used to measure whether or not an objective was attained. For most product outcomes, it is important to obtain a historical baseline of the current performance levels for key metrics so that changes in performance levels can be tracked.

In the case of Teams, let’s consider the first desired buyer outcome and possible OKRs. A relevant objective might be: “Efficiently collaborate with my teams to successfully plan group trips” with key VR product outcome results of:

- 100% of the team trips I planned with Teams were completed based on the plan generated in Teams

- At least 50% of the group trips I took were planned using Teams

- On average, Teams required less than 15 minutes of active time for team members involved in a group trip

- On average, Teams required less than 45 minutes of active time for team coordinators to plan a group trip

- 100% of the team members for trips I planned with Teams used Teams to collaboratively plan the trip

- 100% of the team trips I planned with Teams received a score of “Satisfactory” or better by all team members

In terms of company VR product outcomes, let’s consider OKRs relevant to the $1M ARR target within one year of launch. A relevant objective might be: “Attract sufficient adopters and convert them to paying customers consistent with ARR target” with key VR product outcome results of:

- Recruit and onboard 70,000 freemium customers within the first 6 months of launch

- Achieve a freemium-to-paid conversion of 20% for the first year of launch. (Assuming Teams price of $79/user/year, 70,000 freemium users with an assumed 20% conversion to paid user ratio, gets the company to $1M ARR (70,000 * 0.2 * $79 = $1.1M))

- 40% of users have participated in at least two team trips in Teams within their first 90 days

- 40% of users have initiated a trip in Teams as the Coordinator within their first 60 days

- 50% of users have referred at least 5 users to Teams who have signed up for the service

- Teams has obtained a Net Promoter Score above 40 after 6 months of launch

All of these company product outcomes would likely correlate or lead to the company attaining its desired company and customer outcomes.

To summarize, desired company outcomes are financial performance and power metric targets. Desired company outcomes constrain desired buyer outcomes to be consistent with company outcomes. Desired buyer outcomes define performance targets for the completion of a buyer job. A customer VR product outcome indicates that the customer attained a job-related desired outcome through adopting and using the product. A Company VR product outcome focuses on customers adopting and using the product and correlates and leads to the attainment of a company outcome. Ideally, a product outcome leads to both desired company outcomes and aligns with desired buyer outcomes.

The CPO must manage and balance the tensions and inter-relationships between the trilogy of company outcomes, buyer outcomes, and product outcomes. The outcome trilogy needs to drive product planning and road mapping. Tension can arise in terms of timeframe to accomplish outcomes for each of the trilogy outcomes, breadth of desired outcomes, and in turn cost to deliver stated outcomes. Here are some questions for the CPO to consider:

- Do each of your products have clearly defined desired company, buyer/customer and VR product outcomes?

- How well do the VR product outcomes correlate to customers attaining their desired outcomes?

- How well do the VR product outcomes correlate to the company attaining its desired outcomes?