For a product company, a product value stream is a body of work focused on a particular theme performed by the company to deliver value to the customer and/or the company. In my work with B2B SaaS companies, I have observed a number of different product value streams, including those focused on new products, new markets, new business models, stabilizing and scaling in-market products, and retiring in-market products. It is important for a product manager to understand the different types of product value streams and the sequencing and combination of product value streams that are appropriate for a product at the various stages (early market, bowling alley, tornado, main street) of the technology adoption life cycle (TALC).

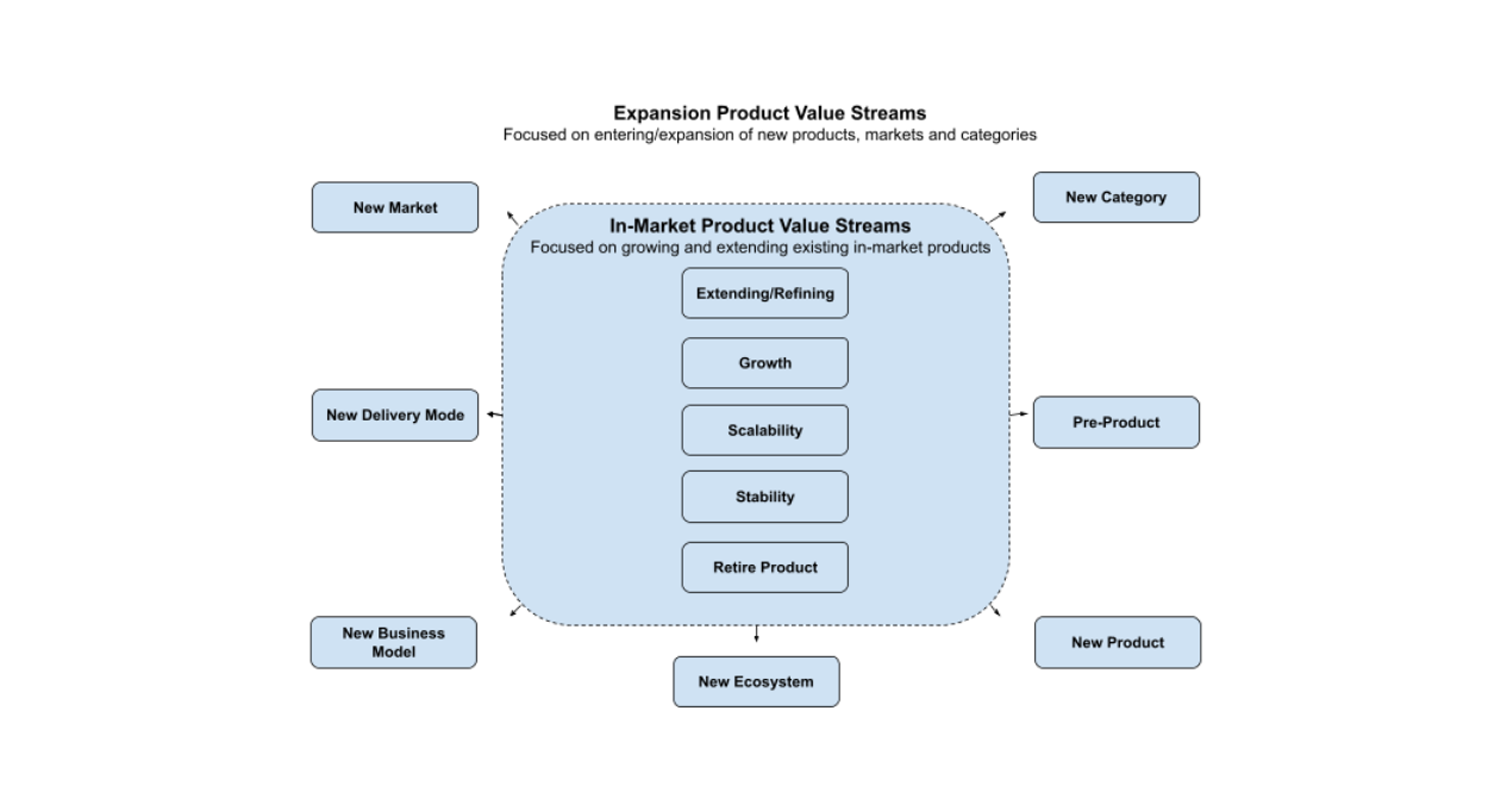

There are two distinct types of product value streams that exist over the life of a product. Expansion product value streams are typically born in product strategy and focus on pre-product exploration and new product creation and expansion into new categories, new markets, new ecosystems, and new business models. In-market product value streams focus on extending, refining, and growing existing in-market products and making them more stable and scalable.

Expansion Product Value Streams

Most companies are focused on expanding their total available market (TAM) over time either due to the maturation and lack of growth in their existing markets or due to the new growth trajectory opportunities of new markets. Such expansion product value streams focus on new products, new markets, new ecosystems, new business models, new delivery modes and even new categories.

I have observed seven different classes of expansion product value streams.

- Pre-product: This value stream allows a company to understand and explore possible solutions to pressing customer problems in service to customers achieving value realization. The intent is for some pre-product value streams to lead to repeatable, configurable SaaS products based on early market project learnings.

- New product: This value stream is focused on the development of new products for an existing market that delivers and captures customer and company value. New products often emerge within existing markets by focusing on new personas, new jobs to be done (“JTBD”), and desired outcomes. Stripe offers a good example here with its initial SMB-market-focused payment product then adding checkout, invoicing, and sales tax.

- New market: This value stream focuses on expanding to new markets (i.e., new verticals, new geographies, new tiers, etc.) with existing products. This may require some refinement to or further enablement of existing product capabilities to address new or similar personas, JTBD, and the associated desired outcomes of new markets. Salesforce offers a good example here as it began with a focus on tech, and leveraged its core product offering into financial services, healthcare, manufacturing, and other adjacent vertical markets.

- New ecosystem: This value stream focuses on integrating product capabilities with 3rd party upstream or downstream products in the category ecosystem for purposes of customer and company value creation related to JTBD and desired outcomes, leading to an expanded addressable market and improved GTM efficiency and effectiveness. For example, many SaaS companies have integrated their products with Salesforce, HubSpot, and other leading enterprise application ecosystems in order to expand their reach.

- New delivery mode: This value stream focuses on the various modes of SaaS delivery in a B2B setting, including multi-tenant cloud, private cloud, edge, mobile and multi-cloud delivery. Multi-tenant cloud is the native delivery mode for most SaaS applications. Vertex, a leading indirect tax SaaS provider has solutions that include multi-tenant cloud, private cloud, and edge and multi-cloud.

- New business model: This value stream focuses on new business model innovations that may include product work related to new pricing models (tiers, term length, move to transactional/consumption vs subscription pricing), bundling or distribution models (including OEM models)). For example, many SaaS companies are moving from subscription-based pricing to transactional/usage-based pricing.

- New category: This product value stream involves moving to new markets with new products (and typically involves launching into a new or refined category). New category product value streams often involve leveraging some existing product or market IP from in-market products. New category creation tends to require substantial investment in R&D as the new product offering emerges. New category expansion work occurs as companies seek new growth curves to ride as their in-market categories are well-matured. Amazon’s move to expand from eCommerce to include AWS and Salesforces’ expansion from CRM to include collaboration (Slack) are good examples of category expansion.

In-Market Product Value Streams

In-market product value streams focus on growth, extension, stability, and scalability of existing in-market products. These value streams are essential to achieving ongoing product-market fit as market needs change and new capabilities are added to in-market products. Care must be taken to find the proper balance between executing on in-market product opportunities and expansion product opportunities.

I have observed five different classes of in-market product value streams.

- Extend/refine product: This value stream focuses on extending and refining product capabilities in existing markets that are habit-forming and deliver and capture increasing customer and company value. This value stream is critical to achieving product-market fit and incrementally expanding fit over time. For example, Zoom expanded its search capability, and improved its background management and meeting detail view in recent releases.

- Stability: This value stream focuses on stabilizing the product by removing defects. The development capacity allocated to stability will vary depending on the maturity of the product but is typically higher following the initial release of new products and capabilities.

- Growth: This value stream focuses on improving key business growth metrics related to new customer acquisition, adoption, usage, customer value realization, retention, referral, or revenue of existing products. Growth of in-market products is typically achieved, not by adding additional product capabilities, but by removing barriers to value with product growth automation related to onboarding, in-app training, better self-service, community portals, etc.

- Scalability: Scalability product value streams focus on removing product and process inefficiencies to ensure that the product and related processes (development, marketing, delivery, operations, CSM, etc.) can deliver against service level agreements (SLAs) for product performance, process performance, product delivery and the like as the user base, data and transaction volumes grow. Not allocating sufficient capacity to this value stream often leads to much unplanned and stressful work due to product scalability issues such as application outages, poor performance, etc. For example, Zoom engineered its products to scale so that during the pandemic its data centers were running at 50% peak capacity.

- Retire product: This value stream focuses on when and how to retire products or specific product capabilities. Retiring a product or product capability is a complex undertaking, however, a positive consequence of product retirement for the product manager to consider is that it frees up resources that can be reallocated to other value streams.

Summary

Product work often involves coordination across multiple product value streams.

One can think of the various expansion and in-market product value streams forming a value stream portfolio that the product manager must effectively manage, given resource constraints. The reality is that most product portfolios include a combination of expansion and in-market product value streams. Product managers must constantly manage the trade-offs between allocating resources to expansion vs in-market product value streams consistent with the overall strategy.

Which product value streams are appropriate for each TALC stage of product category adoption? More on this topic in our next blog.

Does the product value stream taxonomy resonate with you?

Are there missing product value streams? I’d like to hear your thoughts.

How would you characterize your own value stream portfolio? Even starting with Expansion vs. In-Market value streams can be helpful.

Credits: I’d like to acknowledge the helpful feedback and ideas I got from David Rodrigues, Al Nejmeh, and Jon Sappey in earlier versions of this blog. A special acknowledgment to David Rodrigues for his inspiration for the graphic image.