The concept of whole product has been foundational to the software product companies I have worked with and is fundamental to the widely used technology strategy framework Crossing the Chasm. In this seminal work, my colleague, Geoffrey Moore, defines whole product to be “everything required to assure that the target customers can fulfill their compelling reason to buy.” Whole product consists of a generic product as the centerpiece, with complementary hardware/software, system integration and services (installation, change management training, support, etc.). The notion of whole product has stood the test of time and is critical to understanding that there is so much more to customer success and value realization than software functionality. Our language in the SaaS era is different, but the core concept remains fundamental. A whole product includes not just the software capabilities running in a multi-tenant cloud environment, but all of the complementary products, services, and experiences that a customer requires to be successful. The notion of whole product is central to a number of product management frameworks and models I have been developing, including the 5PMM (Five Product Movements Model) and the SaaS Product Imperatives Model.

While Crossing the Chasm was written in a pre-SaaS era and has been updated post-SaaS, the core ideas of whole product remain relevant to SaaS products. Yet the material differences between SaaS and on-premise models suggest a re-examination of the terms used to define whole product. Before elaborating on the components of a SaaS whole product model, I summarize key differences between the SaaS and on-premise models, in a B-to-B context, relevant to whole product.

- A sale is never forever: SaaS products are a series of ongoing experiences, evaluations, and value affirming moments ─ not one-time, monumental purchase decisions. Subscribers typically make annual purchase decisions and SaaS often affords easier migration to alternative SaaS solutions. Since a SaaS sale is never forever, product managers must engage with sales teams to ensure that renewal marketing is tightly coordinated to new feature delivery. In addition, buyer purchases and renewal journey flows must also be thought of as products in terms of automated support and management.

- Democratization of the purchasing process. SaaS subscription purchases and renewals are influenced by the crowd-sourced democratization of company and product reviews. Gone are the days of “for your ears, only” well-guarded and well-rehearsed private customer reference calls shrouded in secrecy. Such references have been replaced by buyer crowd-sourced reference portals (G2, TrustRadius) that aggregate reviews of a customer community, not just a select few reference customers. Furthermore, in the public opinion and viral world of social media, poor product quality and security breaches, etc. get magnified in seconds.

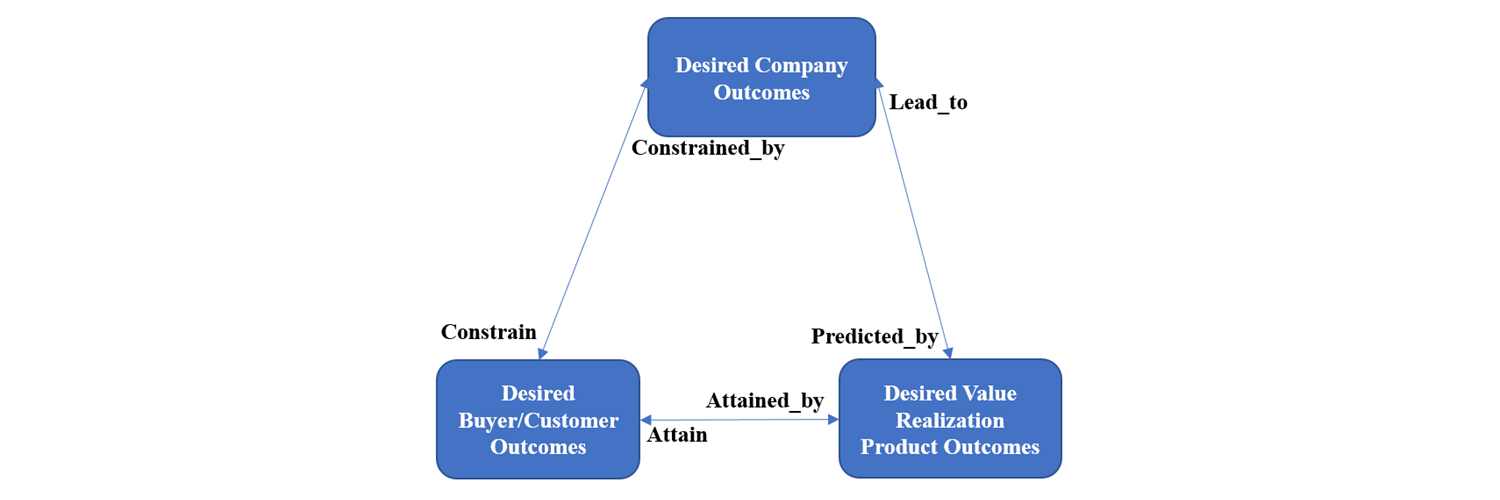

- CSM: The customer success management discipline is a critical success factor for all SaaS companies and has significant whole product implications. CSM begins with ensuring that the customer understands the value they are expecting to obtain from a product. CSM then ensures that the customer realizes the value they expect from the product. This occurs by enabling users through onboarding, training, learning communities, and proactive engagement to drive appropriate and frequent product adoption. Finally, CSM ensures that the customer readily understands and acknowledges the value they are realizing from the product. In short, CSM is about the relentless pursuit of maximizing customer value, thereby leading to increased customer retention, product adoption, and customer ARR growth. CSM, when driven by product telemetry data and pro-active customer outreach based on such data, is substantially different than traditional, reactive customer support.

- Scaled multi–tenancy: deploying a single production version of highly configurable and self-service oriented software for all customers is the normal operating procedure for SaaS and has enormous product and scale implications. The primary motivation here is the lower cost of goods sold through higher asset utilization relative to single-tenant applications. For an excellent treatment on the dimensionality of multi-tenancy, see the definition of multi-tenancy offered by AKF Partners.

- Community: Multi-tenant customers, with strict tenant privacy preserved, are all part of a mega-system of record that offers unparalleled opportunities for anonymous crowd-sourced user and customer data analytics and actionable insights. In addition, the online social learning communities, formally or informally associated with a product, richly contribute to product evolution and user experiences.

- User intimacy: “always connected to the user” SaaS products provide unprecedented transparency on the details of feature-level utilization and actions at the user level, especially when compared to the opaqueness of being unconnected to your users. Such knowledge offers huge potential to understand customer journeys, drive user adoption, and in turn deliver customer value. User intimacy also leads to more collaborative development between customers and SaaS vendors as there is much greater transparency on customer product usage that can drive product innovations.

- Highly Dynamic Roadmaps: The relative ease of a centralized upgrade process, coupled with Agile processes, leads to continuous innovation and high release frequency. Gone are the days when customers are running legacy software releases.This allows for faster pivots and better product discovery compared to on-premise models. In turn, SaaS roadmaps are more dynamic, driven by insights offered from user intimacy, competition, ecosystem participants, etc.

- Regulatory compliance: The cloud comes with greater need to address regulatory compliance and security issues than systems that reside within a corporate facade.

- Platforms as rocket fuel: Platforms, or factored out common services that leverage IaaS and PaaS and other enabling technologies, are the rocket fuel of SaaS products. Such platforms free scarce development resources to solve pressing customer problems, enabling faster customer value realization. A single platform-based product portfolio is much easier to manage and achieve full CI/CD with automated testing. This all contributes to velocity, a key competitive weapon of SaaS. I would argue that platforms offer such great leverage that they are a principal reason why startup SaaS companies come out of nowhere and disrupt and dethrone large, product-minded incumbent ISVs in record time.

- Self-service: SaaS is about user scale, adoption and the ability of customers/users to self-manage such that tasks that used to require services are now productized, affording the user ease of self-enrollment, personalization and use. Think of this as the consumerization of enterprise apps.

- Risk shift: SaaS vendors accept the inherent asset risk (risk of associated assets to run a system) and the operational risk (availability, reliability, etc.) that are transferred to them (or their partners) from the prior “on-premise” owner. In return, SaaS vendors expect recurring revenue (as opposed to license fees) and higher overall operating margins (largely due to lower maintenance costs as a result of fewer “in the wild” on-premise releases).

- Any *: Users at anytime, anywhere and at any device is normal in SaaS and has significant product implications.

- APIs, ecosystems, marketplaces and integration: The SaaS era has ushered in the API economy, marketplaces and unprecedented new applications that all require new product muscle in terms of being a good, global product citizen that plays and integrates well with adjacent parties in your ecosystems, be they upstream (your apps consuming outputs from other apps) or downstream (outputs from your apps being consumed by other apps).

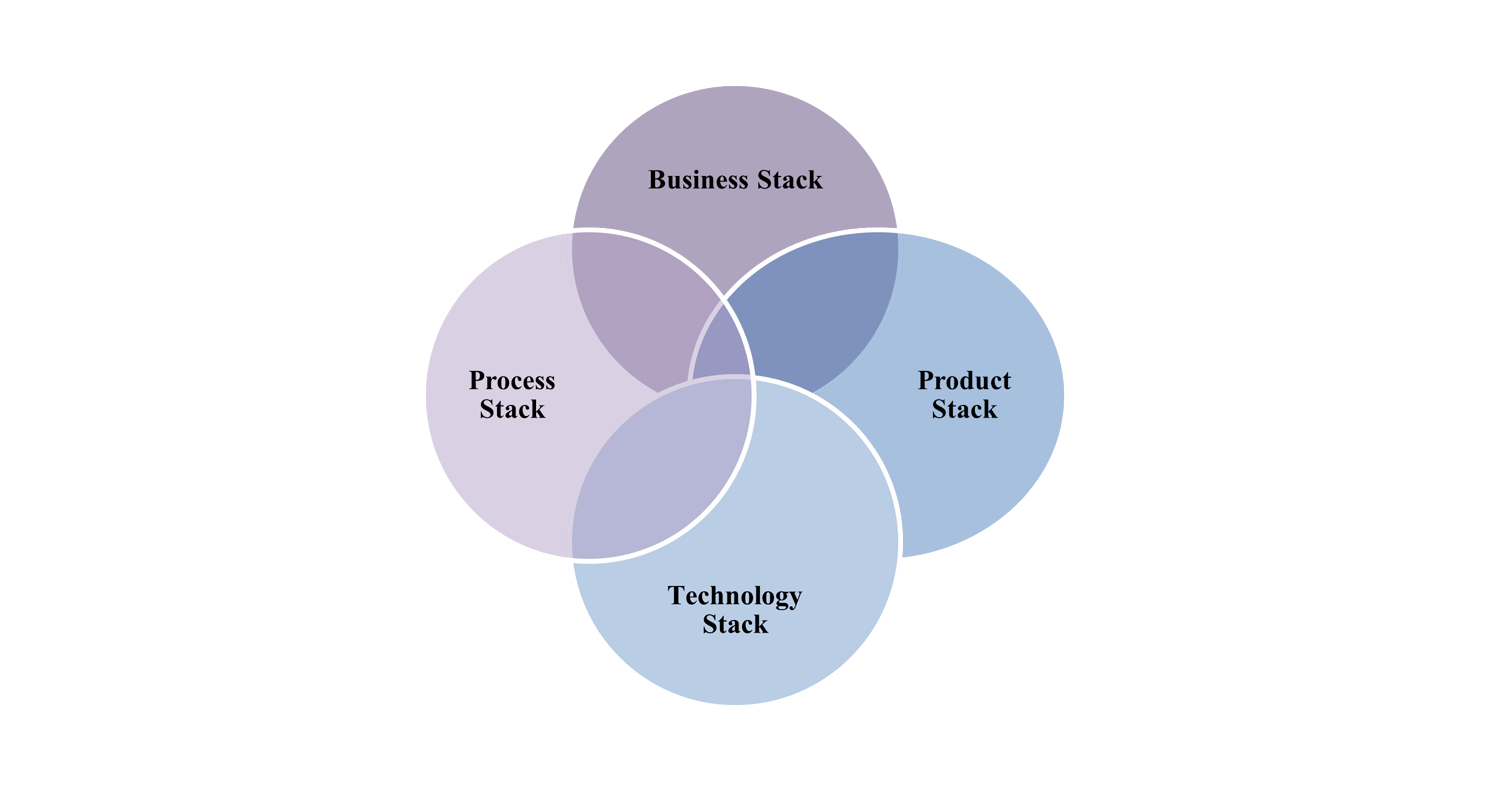

These considerations have informed the extensive work I have done with B-to-B SaaS companies who are looking for a next level, more detailed expression of whole product in terms unique to SaaS. Informed by these collective experiences, I have been evolving a SaaS whole product framework that explicitly takes into account the nuances of SaaS. I introduce the SaaS whole product planning framework here and invite feedback. Part 2 of this blog provides an overview of the SaaS Whole Product Framework. Clearly, a SaaS whole product evolves over time as your category and product mature. Most SaaS whole products begin with an early emphasis on platform, MVP level modular capabilities and the other necessary elements to delivery initial solutions. As SaaS whole products mature, advanced forms of value realization and necessary elements of engagement and ecosystem integrations begin to advance based on on-going customer discovery, competitive pressures, etc.

We’d love to hear your feedback, questions or comments. Please do so via our post on LinkedIn.

Author’ Note: The author is indebted to the many colleagues who informed and matured his thinking on SaaS Whole Product, including

Jon Sappey | Geoffrey Moore | Bob Monroe | Nick Mehta | Marty Abbott

Richard Campione | David Rodrigues | Stephen Ferrell | Arun Venkatadri

Venkatesh Jayaraman | Philip Pettinato | Chris Archambault | Debashish Sasmal

Albert Nejmeh | Scott Williams | Mark Sieczkowski | Patrick Kehoe | Greg Coticchia